The latest survey data from the second Azets Barometer in 2024, indicates a cautiously optimistic outlook among Nordic businesses, with sentiment scores showing slight improvements compared to the previous wave. This aligns with the overall trend observed in the Barometer’s results.

However, confidence levels continue to vary based on geography and company size. Larger businesses consistently exhibit higher optimism and financial confidence than their smaller counterparts, a trend that aligns with previous findings. There are also some interesting differences among the Nordic countries.

Key findings

Geopolitical uncertainty

The latest survey scores reveal a business landscape where concerns have decreased across various dimensions compared to the previous survey. However, geopolitical uncertainty remains the most pressing issue.

Investment Priorities

Digitalisation, cybersecurity, and employee retention remain the primary focus areas for investment. These priorities are consistent with the previous survey, underscoring their ongoing importance in the business landscape.

Cybersecurity

The increase in reported cybersecurity incidents may reflect heightened awareness rather than an actual rise in incidents, highlighting the growing emphasis on cybersecurity measures across the region.

Succession Planning

Succession planning remains a notable weakness, especially among smaller businesses. This persistent issue suggests a need for more robust strategies to ensure long-term leadership stability.

Forecasting and Talent Challenges

Larger businesses tend to have longer forecast horizons, reflecting their broader strategic planning capabilities. Talent challenges persist across all company sizes, with compensation, competitive pressures, and skills shortages being the main concerns. Businesses express more confidence in their ability to retain top talent than to attract new talent, indicating potential challenges in talent acquisition.

Country specific features and findings in the Nordic countries

The following provides an overview of the current state of Nordic businesses, highlighting the key areas of difference, focus areas, and ongoing challenges as they continue to adapt to a dynamic business environment. The findings compared here remain relative to each other and are designed for comparative analysis.

Varying degree of optimism

Denmark has the most optimistic outlook compared to all the countries in the Barometer, as they did in the previous survey. Among the Nordic countries, Finland is the least optimistic according to the Barometer.

Denmark's optimistic outlook could be seen as driven by economic stability, effective social policies, high quality of life, and strong investment in innovation and adaptability. These factors create a favorable environment for businesses and citizens, fostering confidence in the future.

On the other hand, Finland's less optimistic outlook could be influenced by demographic challenges, economic growth constraints, significant skills shortages, and geopolitical concerns. These issues contribute to a more cautious and less positive perspective on future prospects among Finnish businesses and citizens.

Geopolitical uncertainty

Geopolitical uncertainty remains the most pressing issue among the Nordic countries. While the overall score is not extremely high and has not increased since the previous survey, it varies between the countries.

However, it is the single issue where all Nordic countries report the highest level on business concerns. Denmark is the least concerned (4.9), while Finland is most concerned (6.7) on a scale from 0 to 10, where 0 means not concerned and 10 means very concerned.

Finland’s geographic proximity to Russia most certainly contributes to geopolitical concerns, particularly in the context of regional security and economic stability. In the context of the Nordic countries, this issue takes on particular significance given their geographical locations, historical experiences, and current political landscapes. Denmark, Finland, Norway, and Sweden have varying levels of concern about geopolitical uncertainty due to differences in their geopolitical positions and historical contexts. Denmark feels more secure due to its central position in Western Europe and strong integration within NATO and the EU, leading to less concern about geopolitical uncertainty.

Finland faces a higher level of concern due to its historical experiences with Russia and its geographical proximity to a powerful and unpredictable neighbor, increasing its sensitivity to geopolitical instability, despite being an integrated nation of the EU and within NATO.

Compensation and benefits

Companies in Norway (49%) and Sweden (44%) face more pressure to offer competitive compensation compared to those in Denmark (29%).

The statement indicates that companies in Norway and Sweden face more pressure to offer competitive compensation and benefits due to higher costs of living, competitive labor markets, and strong labor expectations. In contrast, companies in Denmark experience less pressure, potentially due to a lower cost of living and a balanced labor market.

Succession planning remains a blind spot for businesses

Nearly 1 in 6 businesses (15%) show no engagement in succession planning, reflected in a moderate overall mean score of 5.1. This indicates that, on average, businesses are only giving some thought to this crucial aspect of organizational continuity and leadership transition.

In the Nordics, Denmark exhibits a more proactive stance, with a mean score of 6.0, though this score has decreased from the previous survey. Conversely, Finland's approach is notably less developed, evidenced by a low score of 3.0, suggesting a potential oversight in future-proofing business leadership. (On a scale from 0 to 10, where 0 means no planning and 10 means planning integrated to strategy.)

The low score in Finland could be due to a variety of factors, such as smaller business sizes with less formalized structures, cultural attitudes towards leadership development, or economic constraints that limit investment in long-term planning. This lack of development in succession planning could leave Finnish businesses more vulnerable to leadership transitions, potentially affecting their long-term stability and growth.

Danish businesses might engage in regular leadership development programs, have formal succession plans, and actively identify and train potential leaders. However, the decrease from a previous higher score suggests that while Denmark is still ahead, there has been a decline in focus or effectiveness. This could be due to changes in business priorities, economic conditions, or challenges in identifying and developing suitable leadership talent.

Recruitment and skills shortage

Businesses in Finland (42%) experience greater skills shortages in the labour market than those in Denmark (27%) and Norway (27%).

The greater skills shortage in Finland can be attributed to demographic challenges, educational mismatches, and rapid technological changes. Educational mismatches could occur when there is a disconnection between the skills being taught in educational institutions and those required by the industries. This misalignment can lead to a shortage of qualified candidates for specific roles.

In contrast, Denmark and Norway benefit from more effective educational systems, supportive labor market policies, and higher immigration rates of skilled workers, which help to alleviate skills shortages.

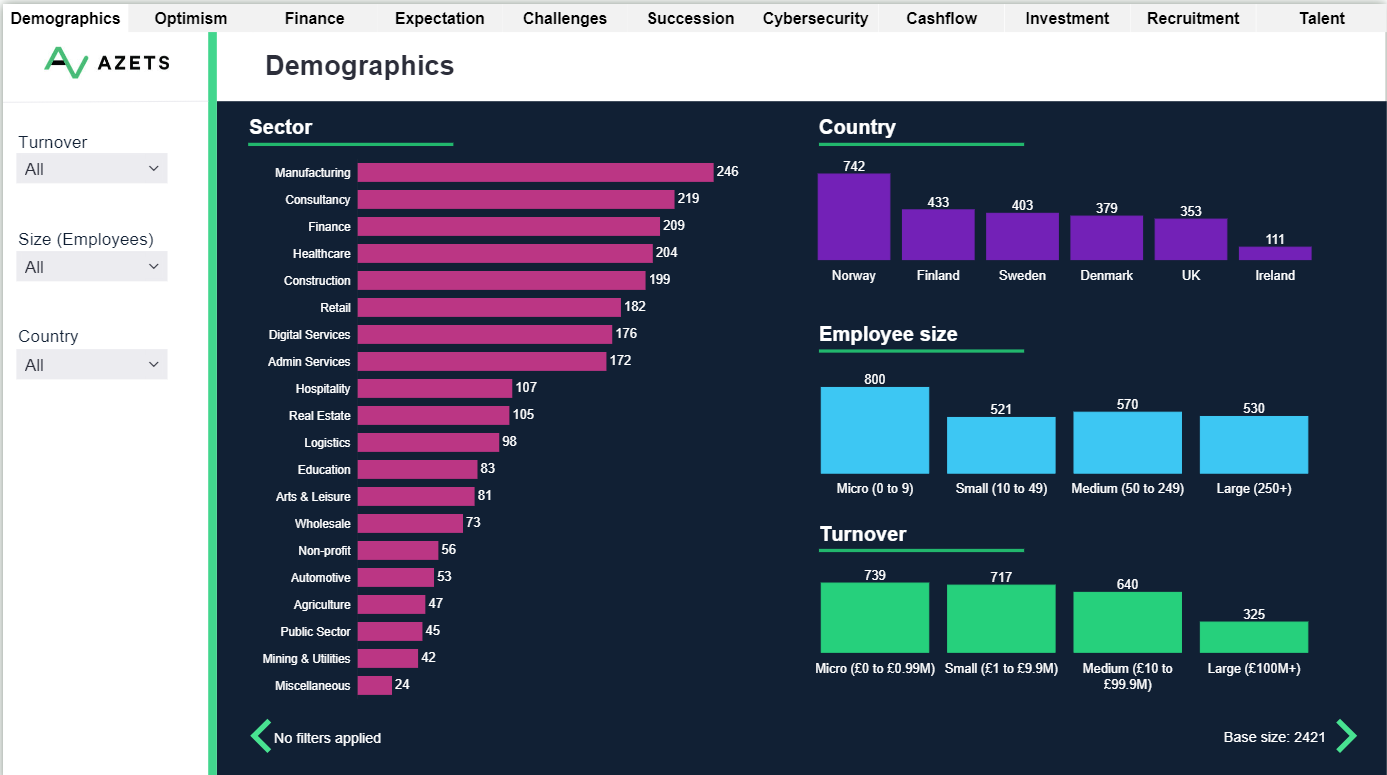

The Azets Barometer provides valuable up to date insight into the current and future business climate in the UK, Ireland, Norway, Finland, Sweden, and Denmark.

Explore the interactive dashboard where you can tailor the report by turnover, number of employees, country and sector.